Embarking on a journey of family finances is more than just balancing books—it’s about nurturing a positive and transparent relationship with money, especially in guiding the younger members of our families. As trusting parents, devoted educators, and passionate life coaches, instilling financial literacy in children paves the way for them to understand that money is not just a tool, but a valuable partner in life. By embracing this process, we unlock personal growth and foster a harmonious well-being, reducing financial anxiety and strengthening family bonds. Together, let’s discover simple and effective ways to engage kids in financial conversations, transforming intimidating topics into enlightening experiences. Join our mission as we explore insightful strategies to inspire financial confidence and awareness in young minds, preparing them for a future of financial mastery.

Introducing Engaging Family Finance Dialogues

The Value of Starting Early

Engaging children in financial discussions early on sets a solid foundation for their future interaction with money. By breaking down complex ideas into simple truths, children learn that money isn’t just limitless and easy—it’s a precious resource that fuels what makes life possible. These nurturing conversations invite curious questions and help children uncover the logic behind smart financial choices. Plus, starting these talks early makes money conversations a natural part of family life, ensuring no money topic feels uncomfortable. Teaching children budgeting basics, the joy of saving, and thoughtful spending creates lifelong habits that empower them. Tackling financial myths early not only combats misconceptions but also builds a loving, positive connection with money, enabling children to make wise financial decisions as they mature. Let’s embrace these early conversations as a gift—a step towards raising financially empowered adults.

Dispelling Financial Myths

Guiding children through financial misconceptions is essential for building a strong, money-wise foundation. Children often inherit myths about money that could cloud their judgment. Common beliefs like money being endless or valuable only for purchasing desires need gentle correction. By fostering open, honest discussions, we can share the true nature of finances—money is earned, it covers both our needs and desires, and it prioritizes what truly matters. Highlighting that wealth doesn’t equate happiness can shift perspectives, helping children grow with balanced, realistic expectations in life. By debunking these misconceptions early, we can steer our children toward appreciating the beauty of financial planning and the thoughtful decision-making it brings.

Every Age Welcome

Financial learning should be as unique as each child—tailored to their age and understanding. For the littlest ones, simple introductions like recognizing coins and seeing money swap for goods cover the basics. Kids aged 6 to 10 can advance to saving for something special and exploring needs versus wants.

Meanwhile, pre-teens and teenagers can dive into exciting topics like managing a budget, bank accounts, and the captivating world of credit and interest. By adjusting financial discussions to fit each child’s stage of growth, we nurture a path of ongoing financial learning that boosts both confidence and skill. Align these lessons with your child’s growth to build empowered, money-savvy individuals ready for whatever adulthood brings.

Recognizing Readiness

Finding the right moment to introduce children to financial lessons can be as easy as noticing their curiosity and interests. When children start asking questions about where money comes from or what things cost, it’s a delightful sign they’re ready for simple financial chats. Interest in handling their own allowance or birthday money is another cue to introduce saving and spending wisely. Pay attention to your child’s math skills—nailing down numbers means they could grasp basic financial ideas. Recognizing these key signs allows parents to weave in financial education when it’s most impactful and engaging, nurturing an appreciation for money management that matures over time.

How to Chat About Budgeting

Simplifying Money Matters

Shining a light on money matters can be as fun as piecing together a simple puzzle that just makes sense. Start by incorporating everyday escapades like trips to the grocery store as mini-lessons in budgeting. Set a fun spending limit and chat about how different items nudge the total cost. Introduce saving by using visual aids like colorful jars or envelopes marked with goals, so kids can visually track their journey. Games become magic moments of learning, with board games and online tools offering exciting ways to grab hold of money management. Real-life peeks, paired with plain talk about things like interest, anchor abstract ideas in relatable terms. By threading these practical lessons into the fabric of daily life, parents create a lasting financial foundation, ensuring children appreciate money management from an early age.

Everyday Budget Lessons

Incorporating financial wisdom into daily adventures makes learning feel as natural as breathing. Everyday tasks, like shopping or concocting a family adventure, become prime lessons in budgetary prowess. Enlist your child’s help in crafting a shopping list while chatting about the budget, discussing each item’s impact on spending, and making team decisions about purchases. This engagement helps children navigate trade-offs, learning to prioritize what’s necessary. Use allowance allocation as another teaching moment—encouraging divisions into saving, spending, and sharing—full of purpose and meaning. Plan outings together, breaking down costs and choosing options that honor the family’s overall financial game plan. By weaving budgeting fundamentals into daily life, children naturally hone financial skills, growing an intuitive understanding of financial management.

Making Money Talks Riveting

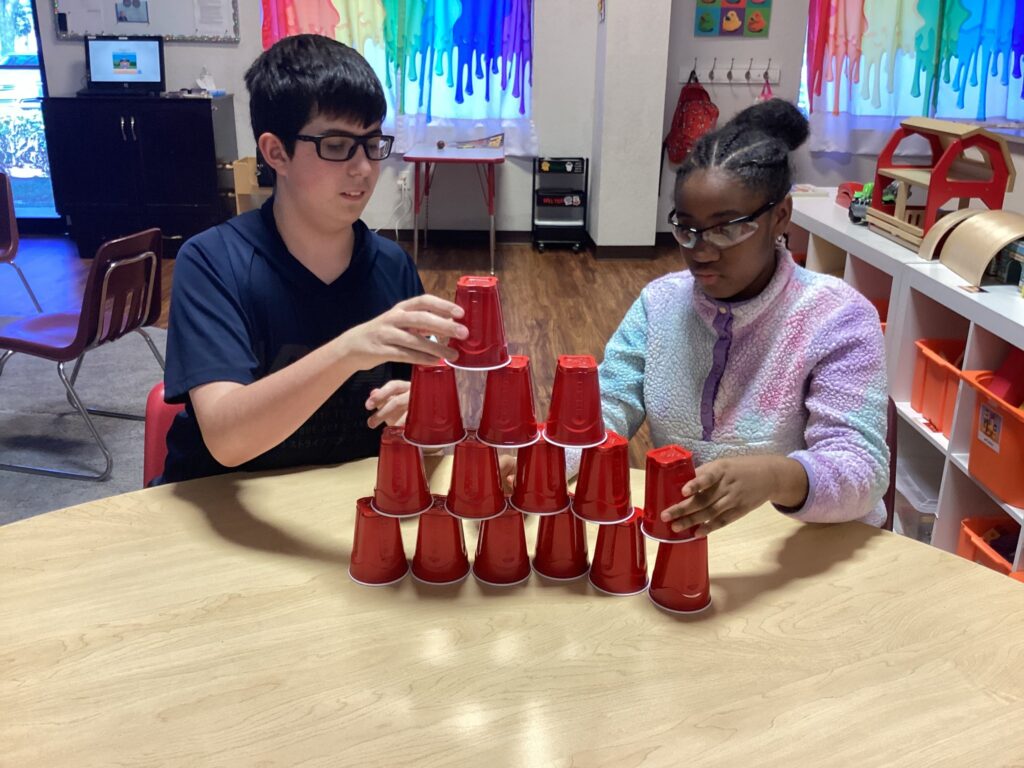

Fun Financial Activities

Making money education exhilarating is child’s play, with fun activities turning serious lessons into memorable joys. Games like “storefront” turn kids into budding entrepreneurs, helping them grasp currency exchange and item value. Play money becomes a tool for learning the magic of change-making and mathematical transactions. Launch a savings challenge by setting financial goals and tracking progress with colorful visual charts, teaching patience and the satisfaction of watching savings grow. Board games like Monopoly unveil budgeting riddles, investing, and the art of embracing risks in a delightful way. Digital apps crafted just for kids offer action-packed finance lessons through interactive quizzes and money scenarios. By transforming financial learning into enjoyable pastimes, parents kindle curiosity and build enduring financial habits in their children.

Rewarding Money Games

Turning financial concepts into games combines learning with joy, cementing understanding through fun. Games such as Monopoly offer a sandbox for practicing buying, selling, and resource management in competitive settings, building strategic thinkers ready to tackle budgeting and investments. A rewards system, giving points for chores completed or savings milestones achieved, reinforces lessons of earning and saving. Points can mean special treats or privileges, instilling the power of delayed gratification and goal-setting. Apps and online games crafted for children present engaging, scenario-driven financial experiences. This mix of interactive, rewarding learning draws children into the world of money management, infusing fun into financial lessons.

Overcoming Challenges in Family Finance Dialogues

Breaking Down Barriers

Facing financial talk resistance—whether experienced by parents or children—calls for creating a warm, openhearted space for dialogue. Gently acknowledge those feelings of unease, casting financial conversations as important family affairs. Welcome inquiries and encourage discussions, showing children it’s safe to express thoughts without fear. Parents can demonstrate openness by sharing their financial ups and downs, imparting cherished lessons from life’s financial path. Gradually unfold these talks, moving beyond one-off lectures to normalized, ongoing conversations. For reluctant children, wrapping money topics around their interests can spark interaction and make concepts more relatable. Exuding patience and highlighting money knowledge as a cherished life skill will transform barriers into gateways for learning.

Embracing Varied Views

Different viewpoints can enrich family finance discussions, leading to greater understanding and unity. Each family member carries personal perspectives, shaped by their unique experiences and journeys with money. Acknowledge and celebrate these differences, as they color thoughts on spending, saving, and financial priorities. Foster an open exchange where everyone can express their viewpoint without fear of judgment, nurturing empathy and commonality.

Parents might dream of family vacations funded by savings, while kids focus on coming fun purchases—by melding these varied aspirations, families find harmony. Shift perspectives to tailor financial lessons to fit each child’s learning style and personality, transforming differences into collaborative goals.

Real-Life Tales and Insights

Stories From Our Hosts

Our hosts extend a treasure trove of stories underscoring why early financial conversations matter. Pamela Furr recalls cherished money talks from her past that enriched her understanding and transparency. Dr. Manny Rodriguez shares tales of budgeting wisdom from a single-income family life, highlighting financial prudence and saving’s value. Missy Owen speaks to parenting’s rewards when integrating children into financial dialogues, cultivating independent, confident individuals. Loki DePristo recounts a family practice of recording expenses, evolving into a valuable habit soothing financial strains. These narratives unveil unique family finance approaches, tailored to each set of family dynamics. As our hosts share, they seek to inspire and propel others to blend financial knowledge into their family chats.

Practical Pathways for Daily Life

Introducing financial lessons into everyday moments turns theory into tactile understanding. One effective method is having children join in on grocery shopping escapades, learning to gauge prices, snag discounts, and keep within budget. Orchestrating family events provides dynamic settings to explore budgeting for outings or vacations, enlightening them to financial preparation’s necessity. Allowance-based learning, encouraging thoughtful divisions for saving, spending, and sharing, teaches balance. A simple family expense chart becomes a tactical blueprint, unveiling how routine expenses like groceries intertwine with budget. By embedding these practical teachings into daily life, families gift children relatable and robust skills to master finances as they grow.

Encouraging Financial Responsibility

Inspiring Earning and Saving

Empowering children with earning and saving habits lays the groundwork for their financial journey. Small tasks or chores for modest allowances can illustrate work’s value and impart a sense of accomplishment. Guide them in setting savings goals with jars or apps tailored to young aspirants. Envision saving for short-term wants, long-term dreams, and encourage growth conversations around the concept of interest—offering bonus interest on savings to show money’s potential to grow. Support them in opening savings accounts for a tactile dive into banking concepts. Through these practical steps, parents can equip children with the inherent joy and responsibility found in earning and saving.

Setting Financial Goals as a Family

Building financial aspirations as a family strengthens collective responsibility and cultivates a nurturing fiscal learning environment. Kickstart the process with a family meeting to discuss unified aims, be it funding a dreamy vacation, a cherished purchase, or shared activities. This interactive journey helps children grasp planning’s power and priority setting’s importance. Harness everyone’s input for achieving these goals, whether through savings, cutting out unnecessary expenses, or increased chores for extra rewards. Visual aids like charts and goal trackers keep motivation high, showcasing achievements as milestones topple. Engaging children in potential challenges invites resilience, showing adaptability within financial frameworks. Working toward goals together reliably enriches family bonds, instills robust financial habits, and nurtures collective success.

Conclusion: Cultivating Financially Savvy Families

A Culture of Open Conversations

Embracing open dialogues about finances births financially thriving families. Begin this odyssey by modeling honesty and a readiness to share mixed financial tales. Discussing money openly disarms its mysteries, embedding its normalcy. Encourage questions and allow thoughts about money to flow freely, framing financial concerns as collective and central to family responsibility. Regular family forums to talk goals, budgets, and progress reinforce openness and break down taboos. Celebrate every financial triumph, no matter the scale, reinforcing teamwork and mutual encouragement. Prioritizing communication ensures each family member gains from shared insights, harnessing the collective power of financial wisdom for unforgettable victories.

Preparing Children for Financial Independence

Guiding children toward financial independence is an enriching voyage, layering practical wisdom from life at home. Coach them on taking small financial reins—managing budgets for personal outlays or stowing away for big dreams. As they mature, usher them into realms of complex financial concepts like banking, credit, and investment. Support teen endeavors into part-time work or internships, immersing them in income management. Discuss the art of setting financial goals and the courage of informed decision-making, underlining long-term planning’s virtues and financial habits’ shaping power. With practical skills alongside critical insight into financial possibilities, you empower them to confidently stride towards a fulfilling financial future and flourish into independent adults.